October 15, 2020

Businesses selling products need to calculate inventory costs as part of filing IRS income tax. It’s not just a matter of knowing your total cost of goods, but using the information for business income deductions. It would be easier if each year, your company started with all new inventory, and at the year-end, the inventory was all sold. The ending inventory cost would be zero, while the beginning inventory cost would be high. But that’s not how it works. Instead, inventory is purchased throughout the year, sometimes at different prices. Sometimes it’s purchased at a lower cost, sometimes at a higher cost. The value of inventory sold is deducted from your company’s sales, as it’s a business expense. This calculation is known as the cost of goods sold (COGS).

Companies, whether a large or small business, use several methods for recordkeeping and accounting to determine the inventory cost for their financial statements. They include:

First in, first out (FIFO): the oldest inventory items are recorded as sold first in an accounting period.

Last in, first out (LIFO): the most recent inventory items are recorded as sold first in an accounting period.

Specific identification: the COGS identifies items individually, like through appraisals (think: expensive jewelry or furs).

Average cost: This accounting method takes the overall average cost of items sold.

The FIFO method and LIFO method are the most popular for inventory management. Here’s how they work.

Inventory Valuation: FIFO

The FIFO method records the oldest inventory as the first items sold, even if that’s not what actually happens. There’s no need to physically track down the older inventory items to ensure the specific first in items from the beginning inventory are gone. FIFO is an inventory valuation method for tax liability purposes, assuming that the first products acquired were the ones included in the cost of goods sold. It mirrors the inventory flow, as businesses would usually sell the oldest items first, whether to ensure freshness for some products or to ensure they are not out of style or date.

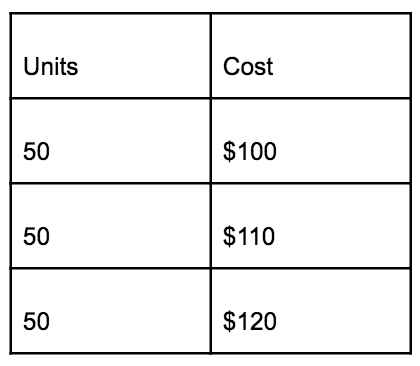

Here’s an example of how to use FIFO.

Let’s say Company X sells 75 inventory items in June. 50 of those units would be the oldest inventory, the first items purchased, at $100; the remaining 25 would be $110. The calculation would be (50 x $100 = $5,000) + (25 x $110 = $2,750) = $7,750 for the total cost of sales using FIFO for June. As for the ending inventory valuation, the balance sheet would be (25 x $110 = $2,750) + (50 x $120 = $6,000) or $8,750 in value.

If prices are rising through the year, using the FIFO method will result in a higher cost inventory value, and also a lower COGS, if you’re comparing it to the LIFO method where there’s also rising prices. In this situation, using the FIFO accounting method would yield higher profits and a higher taxable income statement.

Inventory Valuation: LIFO

The other popular accounting method is LIFO, which logs recent purchases first. The LIFO inventory accounting method is included as generally accepted accounting principles in the United States, but is not accepted by International Financial Reporting Standards (IFRS), and is not used outside the U.S.

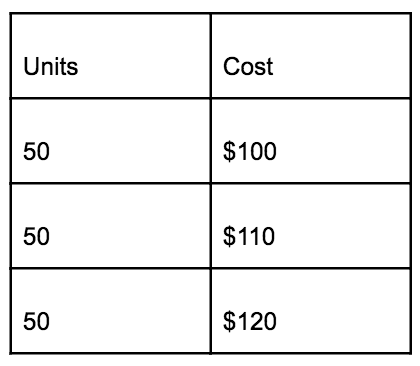

Here’s an example of how to use LIFO.

The same Company X sells 75 inventory items in June, at market value. 50 of those units would be the last items purchased, at $120; 25 would be $110. The cost of sales for June under LIFO would be (50 x $120 = $6,000) + (25 x $110 = $2,750) = $8,570. The balance sheet for ending inventory would include the oldest items, the lower cost ones (50 x $100 = $5,000) + (25 x $110 = $2,750) or $7,750 in value.

The term “LIFO reserve” is the calculated difference between FIFO and LIFO; in this case, it’s $1,000. That $1,000 LIFO reserve is the deferred amount of the company’s taxable income.

If prices are rising through the year, using the recent inventory LIFO method will result in a higher COGS and lower ending inventory value than with the FIFO method. Using the LIFO accounting method here would yield lower profits and lower taxable income.

Publicly-traded U.S. companies choosing LIFO for taxation also need to use it for financial reporting.

Your tax advisor can give advice about the best inventory accounting methods for your small business or large business. This kind of recordkeeping will impact your tax liability, so it’s important to get the best advice.

No matter what method you choose, Stord is available to help with your distributed storage needs. Our proprietary software helps companies with end-to-end visibility, making them run more efficiently.