Here’s the obvious: supply chains are f*cked.

After 2+ years of out-of-stock messages, low inventory levels, and sky-high costs, brands are exploring a wide range of strategies to resolve these issues and strengthen their inventory throughput in 2022 and beyond.

Unfortunately, not all supply chain strategies are created equal. Some appear to be getting a disproportionate amount of media attention, despite the fact that they’re much less common. And others are much more popular, but their impact and efficacy are low.

What trends are we seeing in refortifying supply chains and what do we predict will be most successful?

The Three Types of Supply Chain Strategies Making Waves

Today, we’re seeing businesses take creative approaches to increasing the resiliency of their supply chain, and these strategies boil down to three categories: changes to the way goods are manufactured, transported, and stored.

New Approaches to Manufacturing Goods

One area getting renewed interest is the topic of where we manufacture goods.

Specifically, some companies are considering reshoring—bringing manufacturing domestically —or diversifying their network to include more suppliers in a range of countries. This is, in part, a response to factory shutdowns due to COVID-19, like the one that happened in March in tech hub Shenzhen.

In terms of reshoring, New Balance recently opened a North American manufacturing facility in Massachusetts, and Intel will invest $20 billion in building two new chip factories in Ohio.

Others are bringing manufacturing slightly closer to the end consumer. After Gap experienced factory delays in Vietnam, it started working with Mexican and Central American manufacturers to cut down on lead times.

New Approaches to Storing Goods

Next, we’re seeing brands, like Fat Brain Toys, start to increase stored inventory levels to avoid outages. By planning to have more inventory on hand domestically, businesses can avoid disappointing customers with backordered or out-of-stock items.

As an extension, companies are hoarding warehouse space to accommodate the extra product stored in the U.S. Brands are expanding their warehouse footprint farther away from the coastal ports, like in Reno, Nevada; converting vacant storefronts into fulfillment centers; and planning multistory distribution centers to maximize the space available.

New Approaches to Transporting Goods

Similarly, since it’s taking longer to get goods to the U.S., businesses are experimenting with additional ways of transport. Two popular trends?

Brands, like Gap and Lululemon, are using expensive air freight routes to get items faster and circumvent port congestion.

Sellers, like Home Depot and Walmart, are chartering their own cargo ships to ensure freight capacity for their products.

As the U.S. struggles with low inventory-to-sales ratios, brands are having to spend top dollar to get products in stock quickly.

Which of These Strategies is the Most Feasible?

While brands are likely considering a multitude of the options listed above, that doesn’t mean they’ll execute on every idea.

That’s because some are simply much harder to accomplish.

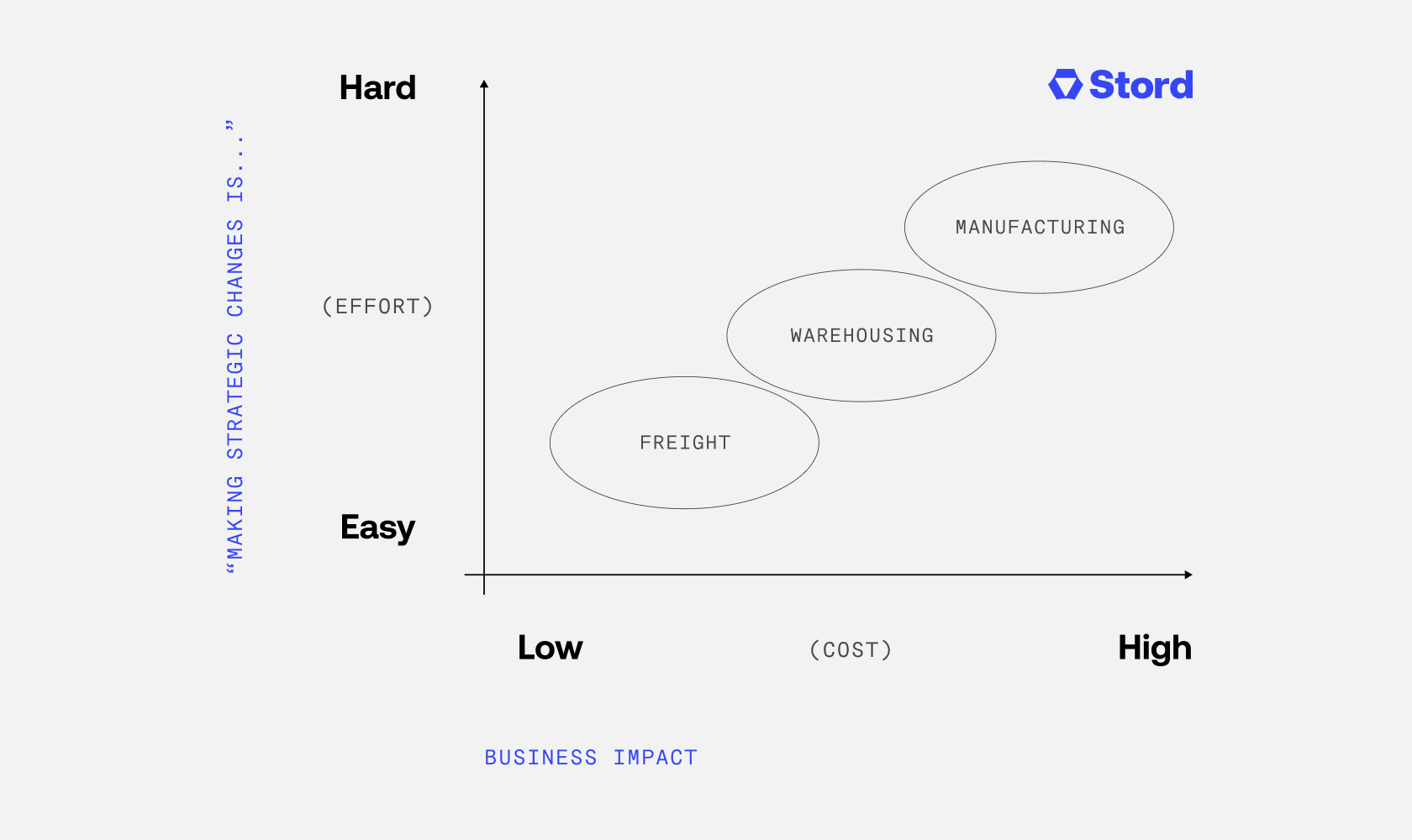

We have a saying here at Stord, “you date your freight providers and marry your warehouse partner.” The same goes for opening up new manufacturing facilities—making and storing goods is a long-term investment, while transportation is relatively short term.

Manufacturing changes tend to be the most challenging. First, there’s the issue of time: it can take years to find the right manufacturing partner or open up a new manufacturing facility.

Second, it can be incredibly costly to switch vendors. According to Harry Moser, founder and president of the Reshoring Initiative, U.S. manufacturing costs are often 40% higher than those in China and other low labor cost countries, which makes it hard for a single company to make changes without broader government backing or greater consumer appetite for increased costs.

It’s a bit easier to make changes to how goods are stored. If you want to increase inventory levels by 5%—the average inventory growth businesses are anticipating post-pandemic—you can likely do that within your existing warehouse network without headache. Therefore, it’s not surprising that 61% of brands took action to increase inventory levels during COVID, but only 25% did the same to regionalize their supply chain.

However, if your warehouse needs are increasing in complexity or you’re testing a new trend, like building a multistory warehouse, then it will take longer for you to see the desired result.

There are a couple factors to determine how time intensive and costly warehouse changes will be—more complex, custom solutions could take a couple months to implement, while more standard setups could be ready within weeks. Factors to consider:

Are you finding a new 3PL to add to your network or do you have an existing partner that can flex to meet your needs as you scale?

Do you need a dedicated warehouse for your brand or are you looking to join an existing warehouse?

Will you require value-added services (VAS), like kitting or special packaging?

Will sorting and packing your items follow a standard flow (i.e. are items about the size of a shoebox, so they can be moved via robots, conveyor belts, etc.?) or will they need special accommodations?

[Editor’s note: if you’re looking for omnichannel warehousing, fulfillment, and freight that’s flexible, fast, and fully connected. Please get in touch with our experts. The Stord team has you covered no matter what you sell, where you ship, or how fast you grow.]

Finally, transportation can be the most flexible, adjustable part of the supply chain process. Of course, transportation is not without its current challenges—getting goods from Asia to the U.S. takes around 80-90 days, the U.S. is grappling with a trucker shortage, etc. But, brands can move quickly to make immediate decisions about each TEU (twenty-foot equivalent unit) if they want goods to arrive faster at an added cost.

Gap was able to toggle between transportation modes to achieve desired business outcomes: quickly switching from ocean freight to air freight in 2021, and now moving back to ocean transportation to save 25% on costs this year.

Which of These Strategies is Most Impactful?

There’s an inverse relationship between the feasibility of these supply chain initiatives and their overall impact on a business (and that business’ supply chain).

The decisions you make regarding your manufacturers have a huge impact on your business. These choices affect:

The quality of your products. A new vendor may not live up to the standards customers have come to expect, causing consumers to lose trust in your brand.

Your capacity to meet demand. Your manufacturers are directly responsible for creating the products you sell. If a new partner is still getting up to speed or botches the onboarding process, you’re at risk of more inventory outages.

Production timing. Brands are heavily reliant on manufacturers to ensure production follows set deadlines. If your current (or future) manufacturer is not meeting expectations, your business and supply chain suffer.

Manufacturing decisions can have a major impact on your supply chain’s resilience. If you move production to the U.S. or Mexico, you’re no longer affected by ocean freight times or port bottlenecks, which would make it faster to get inventory into your warehouses. Bringing manufacturing to the U.S., specifically, would give brands much more control in maintaining an ideal inventory throughput.

But, if you’re considering moving your production to countries across an ocean, in Asia or South America, you’ll still likely run into similar issues facing brands today: uncontrollable factory shutdowns, partners deprioritizing your product, etc. However, diversification may help somewhat to improve your supply chain’s resilience, since issues with one provider won’t completely shut down your operations.

Warehousing and fulfillment is next highest in terms of overall brand impact, because these processes affect:

The speed of product delivery. If any part of the picking, packing, sorting, and carrier handoff flow is slow, items will not arrive on time, causing a negative customer experience.

The quality and presentation of the product upon delivery. The unboxing experience plays a key role in the customer’s interactions with your brand. If the box shows up caved in—or worse, the items inside are broken—you may have an issue with your fulfillment partner. They’re also the ones responsible for kitting your orders, so any special packaging, inserts, or unboxing add-ons that are critical to the experience are done by your warehouse staff.

Inventory management. Brands rely on their warehousing or inventory software to monitor and manage inventory levels. To provide the best customer experience and maximize sales, you need to make sure you can properly plan and restock products.

The right warehousing partner is also critical to the resiliency of your supply chain. By finding a vendor that can elastically-scale physical logistics, all with the speed of the cloud, brands can be more nimble about their operations, better optimizing their inventory and enabling a more efficient supply chain.

Finally, while it’s a critical piece of the supply chain, freight and transportation have a much smaller impact on overall business objectives. That’s because they don't touch the key factors of a customer’s experience—things like product quality, reliability, branded experiences, etc.

Short term transportation solutions can get products in stock quickly, but these one-off strategies won’t have a long-term effect on businesses’ supply chains until broader issues are addressed, like port congestion and air freight costs.

Which Supply Chain Strategy Will Prevail in 2022?

We expect there will continue to be a lot of movement, testing, and stomaching short-term expenses related to transporting goods, as needed, because those types of costs can easily be adjusted on an ad hoc basis.

Along the same vein, many retailers are starting to adopt a just-in-case inventory approach, padding product levels to ensure a positive customer experience without requiring significant changes to their fulfillment contracts.

The bigger question is how many brands will make major changes to their warehousing and/or manufacturing processes? These types of decisions go further than simply solving the inventory shortages that brands may be grappling with today.

Rather, businesses that are exploring new warehouse and manufacturing partners are likely looking to address even deeper issues within their supply chain—things like a lack of visibility, flexibility, resilience, and control in their processes. They need the right partner to transform their logistics from cumbersome cost centers to agile competitive advantages. The brands that enable greater optimization, scalability, and transparency within their supply chain will be the ones to succeed in 2022 and beyond.

If you’re looking for your next supply chain partner, get in touch with us at Stord. You won’t regret it.